Table of Content

This goes on until at the end of the loan, the principal repayments are almost 100% of the monthly annuity. In other words, your savings component increases, month by month, year by year. The more equity or savings you bring in, the lower your loan-to-value ratio LTV and hence the interest rate at which the bank grants you your mortgage. Typically, banks lower the interest rate gradually in 5% steps of the LTV.

The monthly repayment rate comes from the loan amount, the annual interest rate, and the annual repayment rate. Particularly long fixed interest rates are usually higher. This annuity payment consists of both interest and principal repayment. The composition of interest and repayment changes slightly with each month. This is because each repayment reduces the remaining loan balance. Nevertheless, our mortgage calculator is a good start in your search for the best mortgage.

Veterans United Home Loans Amphitheater Box Office Hours

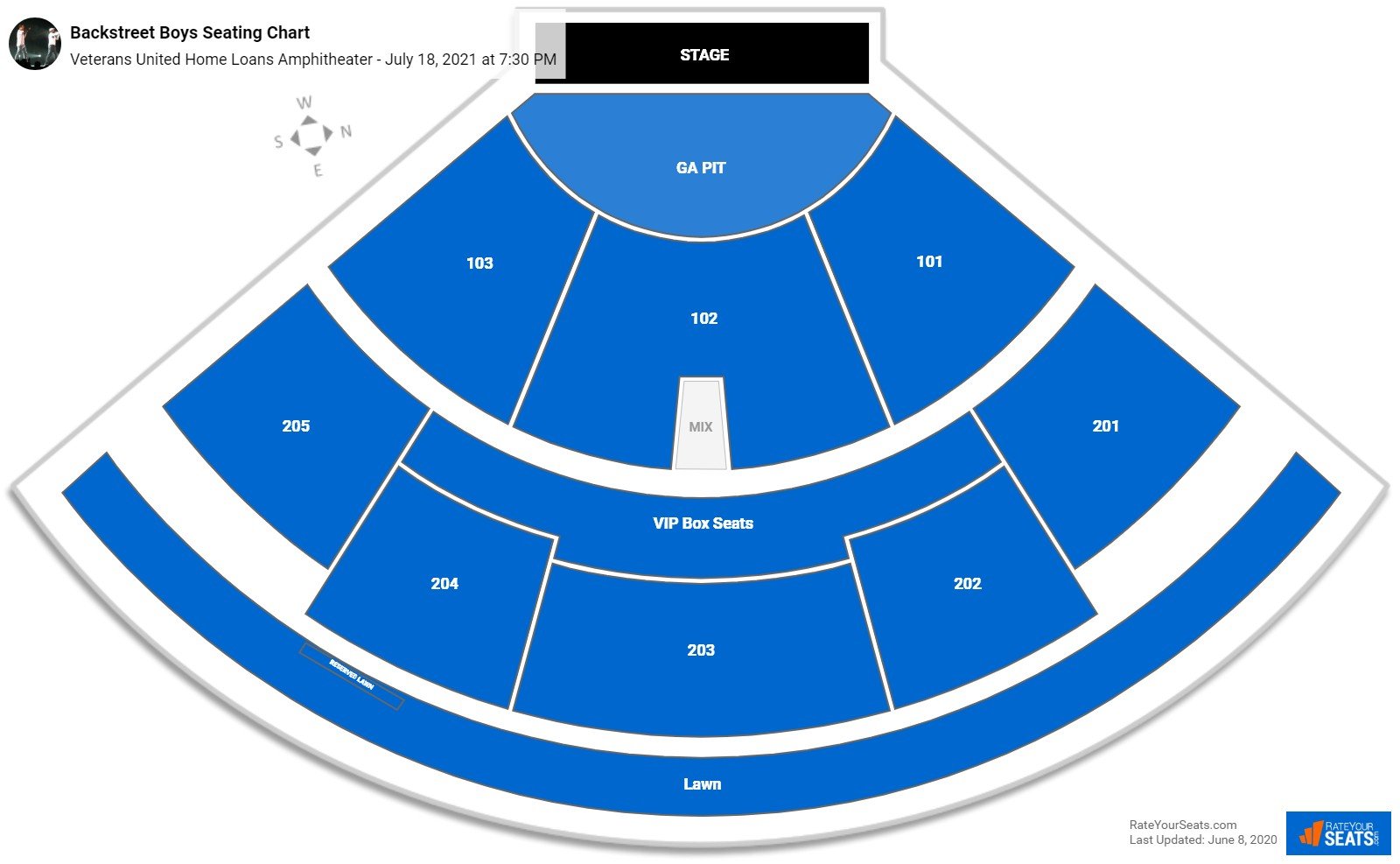

Select the event, date, and time that you want to attend an event at Veterans United Home Loans Amphitheater. Browse and select your seats using the Veterans United Home Loans Amphitheater interactive seating chart, and then simply complete your secure online checkout. Our secure checkout allows users to purchase tickets with a major credit card, PayPal, Apple Pay or by using Affirm to pay over time. Vice versa, the slower you repay your loan, the higher your financing costs will be. How fast you repay your mortgage loan depends on the amount of your monthly rate and additional repayments you may make. In Germany, most banks offer the option of additional repayments between 5% and a maximum of 10% per year.

Needs to review the security of your connection before proceeding. Veterans United Home Loans Amphitheater is a favorite Virginia Beach Attraction. … BUY CONCERT TICKETS NOW Traffic Heavy traffic into the venue is expected. Use our in-house resources to give Veterans a smooth VA Loan experience at every step of their homebuying journey. The Veterans United branch network serves Veterans and military families in the communities they call home.

VA Loan Rates

The amount of equity required cannot be answered in general terms. Fixed interest rateThe longer you fix the interest rate, the more security you have in planning your mortgage loan. However, you also have to accept higher costs, because the longer the fixed interest rate, the higher the interest rate that the bank will call. With a short fixed interest rate period, on the other hand, you benefit from a lower interest rate. But you take a risk as a higher loan balance remains at the end of the fixed interest rate and you may have to take out significantly higher refinancing for it.

To find you the optimal mortgage, we will use our unique Hypofriend Recommendation Engine. We will begin by asking you several key questions, which will help us determine which mortgage products could work best for you. You can use the simple rent or buy calculator to evaluate if buying make sense for you.

Your Virginia VA Loan Experts

Choosing Veterans United was the best decision we've ever made. Such a great experience.Thanks to Veterans United and their awesome team, my kids and I have a brand new place to call home! They made everything sooo easy and I was in my house earlier than my predicted closing date. You can definitely trust VU.Our whole experience with Veterans United was seamless and full of communication. Our team kept things on point from start through clear to close, and kept us at ease during a stressful time. AMAZING, PROFESSIONAL, CARING service.Veterans United rocks!

The rule of thumb is that the monthly mortgage payment should not exceed 40% of your net income. This will ensure you have enough money for your living expenses. Together with our team of experienced brokers, you will understand the nuances of your situation and fine-tune your mortgage decision. Our engine combines modern finance theory with practical insights from our team of mortgage brokers. There isn't a sentence that can accurately describe what James and his team has helped me and my family accomplish.

Consult for free with an advisor to understand your options

They thanked me and Veterans United for making their dreams come true. I had the chance to deliver an envelope containing money to spend, give and save to celebrate a surprise 401K drop for each person at our branch! Join forces with a distinguished panel of former senior enlisted leaders. These experts help educate Veterans on their VA home loan benefits and the perks of working with Veterans United. Manage digital channels, create custom promotional items, coordinate events and book media placements in your community with our marketing team.

I am so happy to be in my new home and grateful for all the hard work from the staff that helped me get here. The waiting times for this flight have not yet been determined or are not available. Please try again later or refer to the information boards at the airport. Although we do everything possible to prepare for the crowds, there may be waits at various points of your journey through the airport. We therefore ask you to help us speed up the process by thoroughly preparing for your outbound and return trips. Our custom optimization engine and expert advisors will help you make the optimal decision for your personal circumstances.

In other words, a higher down payment means a lower LTV and a lower interest rate, and vice versa, a lower down payment means a higher interest rate due to a higher LTV. Check out the Latest schedule of events for Veterans United Home Loans Amphitheater at Virginia Beach. A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency. Customers with questions regarding our loan officers and their licensing may visit the Nationwide Mortgage Licensing System & Directoryfor more information. The results of the German mortgage calculator are realistic sample calculations. However, they do not represent a financing proposal or a financing confirmation.

No matter the time of day or night she always kept us informed of our progress. Your personal mortgage expert will support you to review and understand all your options. We'll calculate your maximum property budget based on your income, savings, residency status and the criteria of our 750+ partner banks. We discuss the outcomes and logic of the recommendations with you. You are different from the average customer, sometimes a little and sometimes a lot.

No comments:

Post a Comment